Delivery Driver Uber Guide to Money in 2020 takes a fresh look at the latest steps. The current offerings of Uber look very attractive. To start, all that is required is a valid driver’s license, be insurable, and be willing to learn. In this post, I will cover the steps to get started and top tips to increase earnings rapidly.

Whether you are new to figuring out if you can do this, or have some experience, the rideshare economy is changing rapidly. Keeping up with the newest platform changes is how the Rapidgo Driver community has your back. Join in and benefit from my decades of experience in delivering passengers, parcels, pantry meals & groceries, and lots of personal pickups.

If you enjoy driving, meeting new people, choosing the hours to work, and adding extra income, becoming a rideshare driver may interest you. This roadmap constitutes an overview of the steps to take to become successful as an Uber driver. Find out if Uber hailing opportunities are available in your area here.

Step 1 – Define Your Outcome

Starting any job venture starts with the goals you want to accomplish.

- How much money do you want to earn driving for Uber?

- How fast do you want to start earning?

- Where do you get help & learn to earn faster?

- Who can you trust to coach you to stay out front in 2020?

How much money do you want to earn driving for Uber?

If you are starting out operating a side gig, it is important to focus on how much you keep from what you earn. The money you have time to earn must meet and surpass the expenses you generate. When earnings are higher than expenses you have surpassed your breakeven point and begin making a profit. At the end of the day, if it cost you more to drive than you make, you will have a short-lived entrepreneurial experience.

Rideshare Expenses for Uber Drivers in 2020

Rideshare expenses for Uber drivers are important to monitor and record as they are deducted from your total income for tax purposes. Currently, rideshare drivers are considered independent contractors, and therefore responsible for their own business operating expenses. A part of submitting local and federal income tax forms will require documentation of all business write-offs.

The key categories of expenses allowable for independent contractors are the expenses for the operation of the vehicle and the expenses for the operation of the business.

Rideshare Expenses for the Operation of the Vehicle

- Car Loan or Car Rental costs

- A portion of the monthly car loan or lease payments may be expensed against income. The percentage amount will be determined by the recorded mileage used for ridesharing use compared to the total distance driven each year. Where car rentals are permitted by Uber, car rental costs may be proportioned, depending on the amount for rideshare use.

- Licensing

- Annual License Plate Renewal Fee is a vehicle expense. (Watch for fees to rise for non-personal use of a licensed vehicle)

- Registration/Inspection & Repair Costs

- Preparing a car to qualify for Uber may require some expense. Inspection for safety may also be required for startup.

- Equipping a car with a two-directional camera, phone holder and easy-clean floormats qualify as expenses for your business.

Rapidgo Driver may earn a referral commission from links.

- Insurance

- The cost of insurance will require a percentage of personal to business miles driven to be a permissible expense. To verify local state regulations, contact a qualified accountant or online representative.

- Maintenance

- Including oil change, car washes, window washer fluid, wiper blades, mechanical and body repairs, passenger damage not covered by Uber.

- Cost of Fuel

- Fuel, gas and diesel, and additives will be the largest recurring vehicle running cost. Credit and discount cards are vital to minimizing expenses.

- Tolls

- Tolls are common rideshare vehicle expense items. Transponders may provide recorded history for tax deductions. In addition, Uber toll reimbursement payments need to be itemized.

Rideshare Business Operating Expenses 2020

- Mobile Phone

- The cost of purchasing a mobile phone and cell phone plans are required expenses for Uber drivers. However, separating personal and business use is necessary to expense a business portion. To easily separate and allocate costs, use a dedicated phone for business. Remember to include additional app costs for mileage trackers.

- Internet Access

- A home office internet cost is a business expense. Confirm allowable percentages with your local accounting firm or online adviser.

- Home Office Space

- Home office space description and allowances are regulated for income tax purposes. Square floorspace dimensions typically define the area and percentage applied to rent, power, and insurance. The area must be dedicated to business only with a door entrance.

- Office Expense – Postage

- Paper communication for business purposes is considered an expense of operating a business as an Uber driver. Mailing forms and fax transmissions costs should be captured for a tax deduction.

- Professional Expense

- The cost of tax preparation and legal fees to establish a business are considered expenses for tax purposes.

- Advertising/Marketing

- As an Uber driver, you have the capability to earn from referrals to the Uber platform. When new passengers and potential drivers use your referral code to register with Uber, you may receive a referral fee thus increasing your earnings. Referral cards with your code in print are an overhead expense for business operation as an advertising and marketing cost. Note: Driver referral fees are dependent on the number of completed rides and rating of a new driver referred.

- Meals During Work Hours

- Meals taken during work hours may be a questionable expense for rideshare drivers. Food and beverages offered to passengers is a permissible expense. Meals, where business matters are conducted, may be permissible if you add to the back of the receipt the reason for the meeting and the name of the person sharing the meal. The distance from your domicile is one measurement for allowance for meals out of town. Clarify with a local accounting firm or online adviser on eligible expenses.

- Medical Insurance

- Medical or health insurance contributions and coverage are the responsibility of the rideshare driver. Part-time drivers may have medical insurance through other employment.

- Home Insurance

- Home and rental insurance are expenses for a home office. Typically, the percentages used for an office space apply to insurance costs.

- Bank Fees – (Monthly Acct Fees, Deposit Fees)Credit Card Fees, and Reimbursements

- Bank fees and credit card annual fees are a cost of doing business. Allocate a credit card and fuel card exclusively for business for easy record keeping.

- Employment Tax

- Self-employed rideshare drivers are responsible for employment taxes to be remitted.

- Training & Education

- Some online training and educational costs relevant to increasing rideshare knowledge and earnings may be business operational costs under office expenses. Consult a specialist.

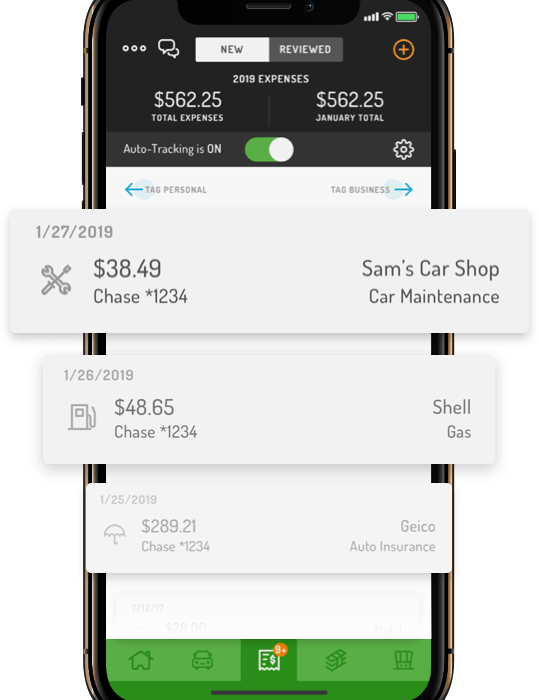

Tracking Rideshare Expenses

Before getting overwhelmed with tracking rideshare expenses, or making costly mistakes that take time and money, let me help simplify the process and keep you on track to make money in 2020.

Rideshare Car Mileage Tracking for 2020

A key measurement required for rideshare expenses is the distance driven for business. Keeping track of mileage or kilometers is essential to identifying personal use versus rideshare use of a vehicle and therefore the expenses allotted.

The Uber driver app will provide details on the distance from the point of picking up a passenger to delivering them to their destination. Additional distance from and to your home and business-related mileage should also be recorded for deduction purposes. Consult government guidelines or a qualified accountant for allowable expense percentages for each expense category.

Tracking apps are used to record rideshare car mileage for business tax deductions on your vehicle. Some apps may simply document the mileage, leaving you to apply appropriately to your tax return. Others will integrate with accounting programs like QuickBooks.

Any tracking app should include all operating costs for the vehicle and the separate operating costs for business administration. My preference is to minimize clicks and have one entry integrate directly to the tax return line item. It saves time and money. The vehicle operating costs tracked should include:

- Car Loan or Car Rental costs, including interest

- Vehicle registration and annual license plate fees

- Fuel

- Repairs & Maintenance

- Insurance

- Tolls

For tax purposes, there are additional administrative costs of business that need to be itemized, categorized, and allocated properly.

- Health Insurance

- Bank, (Monthly & Deposit Fees) Credit Card Fees, and Reimbursements

- Employment/Government Remittances & Tax Obligation

- Mobile Phone – Dedicated to Business

- Home Office

- Internet Access

- Office Space Expense by Square Dimension as a Percent

- Office Expense – Postage

- Professional Fees

- Advertising/Marketing

- Meals During Work Hours

- Home Insurance

- Training & Education

- Tax Preparation

Rapidgo Driver Top Mileage Tracking App Picks 2020

- QuickBooks Self-Employed

- Hurdlr

- Stride Drive

- Everlance

- SherpaShare Mileage/Expense Tracker

- MileWiz

- Easy Logbook

- TrackMyDrive

- MileIQ

- TripLog

- TaxMileage

- FYI Mileage

- MileBug

Disclaimer and advice. State and federal US and Canadian tax regulations change often. The cost of using an accounting firm or online tax return service is a business expense, which lowers the taxable income on a driver’s rideshare earnings.

Speak to a qualified local accountant or online expert during your startup phase of beginning an Uber side-gig. They will provide valuable guidance on the proportionately of each expense allowed by local territory laws.

Understanding Rideshare Uber Expenses 2020

Business expenses are not as complicated as they may appear. Once the purpose is understood, it is a matter of filling in the blanks as quickly and easily as possible and learning how and where to improve the profit outcome. Knowing about these expenses is important.

Incorporation as a rideshare driver business in 2020

Typically, there is not a requirement for rideshare drivers to create a formal business registration. However, depending on your personal needs, or future goals, you may want to seek help setting up a corporation. My personal experience with LegalZoom has been exemplary. They keep things simple, easy to understand, and follow-up.

Rideshare Health Insurance

As a full-time delivery driver for the Uber model, currently, healthcare is a cost to the independent contractor rideshare operator. Personal circumstances will impact the type and cost of healthcare insurance coverage.

Military Veterans starting in rideshare may have healthcare coverage through the VA. According to healthcare.gov/veterans/, if you’re enrolled in TRICARE or the Veterans health care program, you’re considered covered under the health care law. You don’t have to make any changes.

If you don’t have veterans or other health coverage, you can use the Marketplace to enroll in a plan.

Health care coverage can be a business expense if you have a “C” corporation and operate as an employee of the corporation with employee deductions and benefits. Otherwise, healthcare costs are part of your personal income tax 1040 items. Some insurance companies have developed coverage for delivery drivers in addition to Uber rideshare, for low monthly costs.

If your entry into the gig economy is a result of a loss of full-time employment that included healthcare benefits, you may be in the need for temporary healthcare coverage. Short term health insurance for up to three months may fill a gap and is not restricted to open enrollment periods.

Rideshare Car Insurance

Insurance is required to operate a vehicle. In the case of accident and damage to person and property, insurance provides coverage for the expenses. The current standard for rideshare drivers is that there is no clear current standard.

Several estimates I have seen suggest that 60% plus of rideshare drivers are not properly insured. State requirements for rideshare liabilities are evolving. Insurance companies are slowly providing unique rideshare and food delivery vehicle coverage.

The key component here for the insurance companies is that you are making your vehicle available for hire. For the insurance companies, this converts the requirement from personal use to commercial use. Commercial use means more miles driven, increasing risk for accidents.

Uber requires and provides insurance coverage in the US for their delivery drivers while on route to pick up a passenger and during passenger transport. Due to the volatility of the rideshare industry and inexperience in the new area of coverage, some insurance companies are turning their backs on the entire “independent contractor” segment.

Several companies recommended by Uber are adding commercial insurance riders for the additional coverage. Others are rewriting the coverage for each vehicle to encompass ridesharing coverage.

The three times a driver requires coverage:

- Waiting for a ride, signed into the Uber app

- On route to the pickup location

- On route to the destination with passenger

Traditional insurance is in-effect while waiting for a passenger request. Uber rideshare insurance has its maximum effect once the passenger has been picked up. The time in between receiving the request and the time of passenger pickup is termed “Gap” coverage.

Some companies will make the coverage a “Gap” coverage, with added fees. Others will categorize the coverage as Rideshare and charge a higher rate. Here is an overview of “Gap” coverage.

Uber provides access to drivers to several insurance companies for rideshare coverage and details their requirements HERE. Check the current coverage by the state for each company online.

Rapidgo Driver Top Ten Rideshare Insurance Companies for 2020

Rideshare Fuel Credit Cards for 2020

Fuel, gas and diesel, and fuel additives will be the most frequent expense for rideshare drivers. As a business owner, the fuel used to earn an income is an expense. It also represents opportunities to reduce fuel costs and earn cash back or travel options.

Here is my sage advice from years of business development. Record expenses as soon as possible with as little effort as possible. It is better to focus on what makes you money.

Whenever possible, use only one credit card for business operating expenses. Vital to keeping profits high is to pay off a credit card every month. It eliminates interest charges and makes record keeping much simpler.

Set up an automatic minimum payment amount for each month from your bank account. Include an email notification of upcoming transfer as a reminder to pay it off and avoid interest costs. Remember to expense any credit card annual fee as a business expense.

The type of credit card you use depends on your personal preferences and goals. If travel is your hot button for earning extra money, then sign up for a credit card with maximum allowance for air miles. If minimizing immediate expenses is your goal, then a cashback option may be your best choice.

The best credit card features for rideshare drivers include:

- Rewards to use for purchases

- Reward cards generate points from purchases and apply them toward future purchases.

- Cashback as a percentage of specific purchases

- Cashback cards return a percentage of purchases as a rebate to the card account.

- No Annual Fee

- Annual fees of $80+ are typical expenses for cards with the greatest rewards.

- Signup Bonus & Cash Back Rewards

- Currently, signup rewards from $150 to $300 are attractive. Typically, minimum purchases of upwards of $3000 over the first 90 days are required to qualify. That’s equal to approximately 85 fuel fill-ups (About once per day) at $35 in ninety days.

Rapidgo Driver Credit Card Top Picks

- USA – Signup Bous, No Annual Fee, 3% Gas Cashback

- Canada

- TD Canada Trust Travel Rewards

Delivery Driver Uber Guide to Money – Top Rideshare Maintenance Hacks and Service Options for 2020

It makes no economic sense to begin a rideshare side-gig and not have a plan to take care of the vehicle and tools required for the job. Believe me, sitting at the side of the road, not only spending money but also losing income, should be avoided when at all possible.

Roadside Assistance for Uber drivers for 2020

Most late-model cars purchased, leased, or rented include, or offer, roadside assistance coverage for vehicle breakdowns. In the unexpected no-go experience, the faster you get back on the road, the better.

Plan for mayhem in advance with top-rated roadside assistance service and make one call for fast service. One towing charge may well exceed the annual investment in peace of mind.

Uber Nationwide perks

Uber has partnered nationwide with providers to support their drivers. Here are their current partners listed for:

- Phones – Partnering with AT&T, Sprint, and Verizon to save you 15-18% on your monthly bill. And that savings can be extended to your immediate family

- Maintenance – Get up to 15% off at Auto-Zone, Firestone, Maaco, Meineke, Midas, Jiffy Lube, and Valvoline –

- Health Insurance – Stride Health

- Financial Tracking – H&R Block and Intuit

Maintenance Program for Delivery Driver Uber Guide to Money in 2020

Uber requires all vehicles used for ridesharing to be mechanically safe. A planned maintenance schedule is essential to maximizing earnings and profits.

- Stay on the road making money

- As a rideshare driver, you make money with passengers in the car. The more focus put on finding the highest paying passengers the more income. Scheduled maintenance provides time for other business matters.

- Schedule downtime

- Create schedules for oil changes, tire rotation, and even car washes. Repairs and maintenance should be scheduled outside primetime income hours.

- Control and minimize expenses

- Knowing the costs in advance of scheduling repairs encourages finding the least expensive local enterprise to support. Repeat business to a local supplier often benefits in having your car serviced quickly. Scheduling also allows budget planning for the lowest impact on cashflow.

Best Cars for Uber Rideshare Drivers 2020

The Uber service you are interested in developing will determine the best vehicle suited for the job.

Uber offers service with the following vehicle types as described here:

- UberX

- Newer 4-door, hybrid compact cars costing the least to operate

- UberXL

- 7-passenger vehicles earn more & cost more to operate

- Select

- Mid-tier luxury sedan required, subject to local needs

- Black

- Black car, white-glove service, Uber authorized, Audi BMW, Cadillac, Chevrolet, subject to local needs

- Comfort

- Larger 4-door, Uber authorized, Aura, Audi, Bentley, BMW

To qualify for Select, Black, and Comfort a driver must already have high existing passenger ratings and meet a predetermined number of completed rides. If you have already earned experience as a cab driver, you know the quality of service needed for Uber-Black car. To review qualifications and earnings for a cab driver, visit Zappia.com.

Rapidgo Driver Recommended Cars for UberX 2020 – Starting Out

Uber car requirements allow for numerous makes and models of cars. For rideshare, the lowest costs for driving and maintenance define the best car.

Congratulations if you have a four-door, hybrid, undamaged, late-model car without any financing. Your costs will be the least. All you will have are the operating costs of a vehicle. Not having a monthly finance expense will increase your profits substantially.

If you are unsure whether your present vehicle will qualify, begin the driver signup process to be advised by Uber of acceptance.

Typically, these car types are used most successfully for basic rideshare UberX in 2020.

- Hybrid, late-model makes that exceed 55 miles per gallon fuel usage. High mileage per gallon of gas and low maintenance costs are keys to high profits.

From the sage advice corner, car part replacement costs are important expenses to pre-consider when thinking about operating a high use vehicle. Replacement brake pads, front-end parts, and transmission parts are typically less expensive for non-import models.

Car Rental for Delivery Driver Uber Guide to Money in 2020

Starting a rideshare gig without a car is an obstacle many drivers may experience. If your current vehicle is going to guzzle fuel and require high maintenance costs, or you don’t have a car that Uber would qualify, you may consider leasing a replacement or renting from an Uber approved partner.

Vehicle Rentals approved by Uber include:

Rentals offer the options of renting by the day, week, or month, thus increasing flexibility and control of expenses.

The tradeoff in renting is the expense may be higher than not renting and managing all the repairs and maintenance, insurance, and registration yourself. Many aspects of business, like renting and tracking and accounting apps, are time savers and worth the costs. Anytime you can pay a little more to have the peace-of-mind of someone else looking after some areas while you concentrate on what brings in the most money, you improve your income.

An upside for renting a car is that your monthly expenses for other than fuel are known. If you already own a vehicle that does not qualify for Uber, consider expensing the entire cost of a rental unit rather than a percentage of costs for a car used for both personal and business use. You would need to prove the car is used only for income earning. Consult your local accounting firm or online professional to apply properly to your income tax return.

Rideshare Uber Driver Tax Tips for 2020

Delivery Driver Uber Guide to Money in 2020 Tax Tips help you focus on profits. Trust me, tax-time can be made easy. The first and most important effort you can put forward is to begin recording, categorizing, and allocating expenses from the start.

Regardless of where your expense numbers originate, they must all come together on one form to the IRS in the US or the CRA in Canada. The goal is to provide timely and accurate calculations to make line items on the self-employed tax forms easy.

Rapidgo Driver encourages all drivers to develop a tracking system that allows them to concentrate all their efforts to earn more and save on expenses as the utmost priority.

My experience with TurboTax has saved me thousands of dollars and hours of time and is available in both the US & Canada.

TurboTax US for Small Business -for the IRS you will need to complete IRS 1040 & 1099

TurboTax Canada – for the CRA you will need to complete T2125

Rideshare Uber Income 2020

Knowing the expenses to expect in your business startup should encourage you to spend most of your time making money in 2020, not record keeping.

Now that your expenses are recorded and allocated to the allowable tax line, let’s look at the income potential as an Uber rideshare driver. Defining the amount, a rideshare driver earns, is more of an evolving guess than a proven hourly rate. What’s most important is does the amount earned exceed the financial and time costs.

The fluctuation factors discussed in Rideshare’s expenses makes arriving at a perfect number for income foggy at best. My years of delivery driving tell me it is more a range than a set hourly figure. The gross earnings from the driving I have experienced and those I have interviewed say actual Uber income from driving ranges from US$17-US$28 an hour while actively earning, depending on the location.

Signup Bonus as Earnings

Uber promotes a signup bonus in areas offering an expansion of its services and support. As you start your signup process you will see your local bonus structure and how it works.

From the Uber site:

Earnings from your fares and surge (after service fees and certain charges are deducted, such as city or local government charges) are included toward your guarantee offer amount; any tips and/ or other incentives you make are on top of that amount. If you complete the required number of trips within 90 days of signup and you earn less than the guarantee offer amount, then you’ll receive the difference.

For example, if your guarantee offer amount is $1,000 and you earn $800 in fares, an additional $100 in tips, and an additional $50 in promotions (for a total of $950), you would receive an additional $200 because your fares didn’t meet the guarantee offer amount.

How fast can I start earning money with Uber?

The signup process with Uber may take days up to weeks. Their vetting process includes outside reports that typically require days. It mostly depends on having the correct documents, submitted properly. See the list of documents needed below to start the signup process.

Typical delays in your signup process may be caused by vehicle repairs needed to pass inspection for Uber or obtaining rideshare insurance. Once you receive your Uber window ID and license plate ID in the mail, you are ready to access the Uber app with your driver code.

Where can I get help & learn to earn faster?

As in any job, the fastest way to learn the tricks is to be partnered with someone with experience. My mission is to help you cut through the jargon and bypass the mishaps to get you earning more money, faster than if you learned from all your own guesses and mistakes.

Help from Uber continues to expand and improve. As a result of the Uber experience expanding so rapidly over several years, numerous drivers have formed communities where current changes are reviewed and debated. Due to the shifting landscape, Uber regularly updates its platform without warning. Rapidgo Driver has your back as we stay ahead of changes and inform the Rapidgo Driver community with advance notice where possible, and profit recommendations. Sign up for weekly Rapidgo Driver Newsletter to stay on top of the latest changes impacting Uber rideshare drivers.

If you are near a large city, Uber provides Greenlight Spots & Hubs to help support drivers. There does not seem to be a complete national list of locations. Part of the signup process will align you with your nearest city and Greenlight locations will then become apparent.

Who can I trust to coach me to stay out front?

With over thirty years of experience in delivering more things than you can imagine, I have spent thousands of hours experiencing the real world of picking up in one place and delivering in another place. My ability to stay ahead of the changing curve has not only helped me create business for myself but has helped me transfer that knowledge to other drivers looking to earn more. This means that you can count on my experience to shorten the time for you to earn more money. Remember, I am an Uber driver too. Get the latest changes impacting rideshare drivers.

Step 2 – Obtain your Uber driver code

How the Driver App Works

To start to become familiar with how the Uber app works for drivers, watch this video.

How to Start Driving with Uber? Sign up to register.

A review of current Uber offerings for signing up as a driver can be found here. Uber offers a driver guarantee when you start as an incentive. Check your local city driver guarantee for the latest signup incentive as part of your signup process.

Uber 2020 overview of signup requirements from its site.

Sign up Bonus Example – $1000 Uber Driver Guarantee for Your First 150 Trips (Within 90 Days)

Uber doesn’t publish a list of sign-up bonuses, but you can e-mail support@uber.com to verify the amount and terms for your city. Uber drivers may earn referral fees when they help a new driver succeed in reaching Uber Driver Guarantee startup goals.

Anyone can drive for Uber. Here are the minimum current requirements determined by the city, when you signup.

- Meet the minimum driving age for your city

- Proof of at least one year of license history in the US if over 23 years old. Three years of history are required if you are under 23 years of age

- Provide proof of current valid driver’s license

- According to Uber, all vehicles operating on the Uber platform must meet the following requirements:

- Must have 4 doors and be able to transport a minimum of 4 passengers

- Must be 15 model years old or newer. Uber restricts model year by the city. Start the signup process to confirm the requirements for your location.

- The title cannot be salvaged, reconstructed, or rebuilt

- Rental vehicles are not allowed on the Uber platform, unless from a vehicle solutions partner, and may result in a permanent ban.

- Cannot have any cosmetic damage missing pieces, commercial branding or taxi paint jobs

- Depending on your location and your vehicle description you may be required to have your car inspected at an Uber Greenlight Spot location.

In order to get registered with Uber, you will be required to provide the following.

- Proof of a current US driver’s license – one-year history, 3-years history for under 23 years of age – No more than three minor moving violations in the past three years, such as speeding tickets or failure to obey traffic laws.

- Proof of residency in your city, state, or province

- Proof of ride-hail vehicle insurance for the car you plan on driving

- A driver profile photo meeting strict requirements

In order to register with Uber, you will be required to complete the following steps of the signup process.

- Submit the documents and photo

- Provide background check information – A criminal record that does not include a conviction for a felony, violent crime, or sexual offense within the last seven years, among other things such as a registration on the U.S. Department of Justice National Sex Offender Public Website.

- Submit your car for examination to determine the eligibility

- There may be additional requirements depending on your state or city

- Wait until Uber reviews your application and sends your access code – 5-10 days

- Download and install the Uber app and start driving

To improve on the base earnings in various cities, Uber additionally awards location and time ride uplifts. The earnings advantage is from higher traffic demand during peak times, in peak areas. By working during peak times and locations, rideshare drivers can expect to increase their earnings. The concept is simple, keep your vehicle full of passengers.

Uber Terms and Conditions

As with most app downloads, there are Terms & Conditions using the Uber platform. Rapidgo Driver encourages you to read and understand your commitments.

Uber updates its terms and conditions at which point the driver is required to accept to access the rideshare app. Parts of the terms and conditions may be opted out from, e.g. arbitration agreement, when submitting required email within thirty days of accepting the agreement.

OK, Next!

The next question should be how long will I be able to earn money once I invest my time and energy into ridesharing? Here’s an alert. Not all rideshare companies and apps are going to make it over time.

ICYMI. Starting next year, Lyft will take over the New York corporate rideshare extension, Juno. Juno was backed by Volkswagen according to Techcrunch, as a competitor to Uber. In an overnight change, hundreds of Juno drivers discovered they had no income source until applying to Lyft and being accepted.

Even Uber has had its setbacks. The pushback from communities regarding the safety of passengers in London caused a devastating impact on drivers suddenly being left short needed income. Recently, Uber withdrew from the market in Columbia.

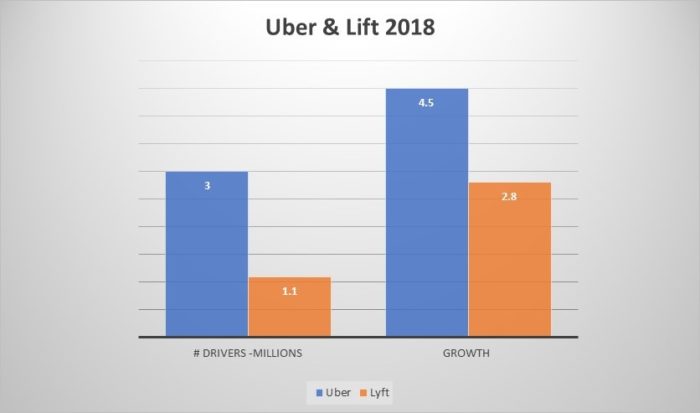

The Uber rideshare market is steadily increasing, however, which means more drivers are needed. Uber and Lyft both trade on the stock exchange and therefore publicly post earnings and profits. Because their investors want growth and security, they both respond to market demands for more riders. Both companies are actively recruiting drivers and creating new markets

One new market at the Ohio State campus meets a local community need. Lyft Ride Smart app at Ohio State caters to specific daytime hours and specific campus ride areas in response to safety concerns in the overnight hours.

For the foreseeable future, rideshare is expected to rise in popularity, especially in the 25-34-year-old demographic according to the Statista Global Consumer Survey July 2018.

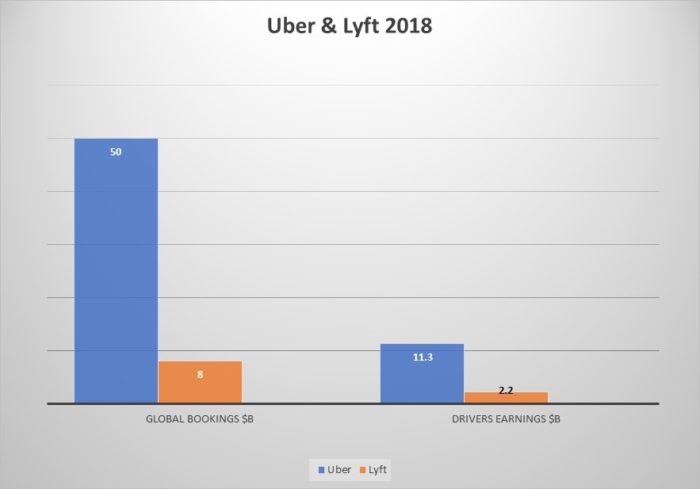

Looking at the current rideshare market, compare existing global earnings for the top two rideshare contenders. Comparing global bookings for Uber and Lyft below reflect all sources of revenue streams, including rideshare, food delivery, freight, and package delivery. The percentage earned by drivers from Uber include all types of deliveries.

As rideshare and other forms of delivery requirements grow, the number of drivers will increase. Both Uber and Lyft forecast growth in driver numbers.

Delivery driver strategies for 2020 take advantage of expanding driver app platform usage beyond rideshare service. With multiple income possibilities, delivery drivers reduce damaging their income if one company suddenly disappears from a market.

Over time, other areas needing on-demand delivery drivers will increase. Sign up for weekly topics about important developments for all delivery drivers. Rapidgo Driver will keep you informed in the areas of:

- Passenger Rideshare

- Parcel Delivery

- Pantry Meal & Grocery Delivery

- Product Pickup Requests & Delivery

Uber encourages its drivers to expand their earnings from these areas as well. With the addition of Uber Eats deliveries, drivers are coaxed to deliver passengers and meals with the same vehicle.

A search through Indeed.com provides updated earnings for multiple delivery driver positions. You will find current earnings for driver specialties along with contact information by location.

Where Uber sees future growth including driverless delivery vehicles and drone delivery systems. numerous other companies with deep pockets for R&D, UPS, FedEx, Google, and Amazon are focused on similar development.

Step 3 – Maximize Uber Earnings and Minimize Expenses

What to Expect Starting to Drive for Rideshare Uber

Using the Uber Driver App 2020

If you are new to the Uber app, starting with some definitions and links will help you begin to understand the terminology of Fees and Promotions.

Uber Definition of Terms:

- Service Fee

- Uber unlocks to the driver 75% of the Service Fee charged to the passenger for UberX (Excluding Pool). For larger and specialty vehicles, Uber remits 72%.

- Booking Fee

- The Booking Fee is a separate flat fee added to every trip on products like UberX and UberPool. It is included in the rider’s total fare and does not impact the amount the driver earns for each trip. It covers regulatory, safety, and operational costs, including insurance protection for drivers and riders on every trip.

- Pool

- Watch this UberPool video. Riders heading in the same direction choose to share a ride. Uber finds the best route to pick up multiple riders along an UberPool trip. This means more time driving and less time waiting for your next trip request.

- Boost

- Boost, along with Surge are names of promotions. Promotions add income by multiplying the normal rate to the driver by a fluctuating factor.

- Surge

- Surge pricing applies in certain cities to increase earnings during peak passenger and time periods. The Surge promotion may be earned along with Boost promotions where available.

- Uber Pro

- The Uber Pro program rewards drivers with additional earnings potential with Quest and unlocks additional benefits to drivers. Uber Pro is reached by meeting requirements here.

- Gold, Platinum, Diamond Levels

- Passengers have reward levels. With more use of Uber rideshare and Uber Eats Delivery, riders unlock benefits, including being paired with higher-level drivers.

From Uber:

If you’re ever unclear, you can

verify promotion details in your Driver app by following these steps in your

Driver App:

Tap your profile photo in the upper right corner of the app

Select Earnings from the top menu

Tap “Promotions”

Uber has blog posts, YouTube videos as well as excellent resource starting points material for new drivers.

Here are some helpful links to Uber NA

- Blog – Driver Announcements

- Uber – Products Overview

Delivery Driver Uber Guide to Money in 2020 – January 2020 Updates

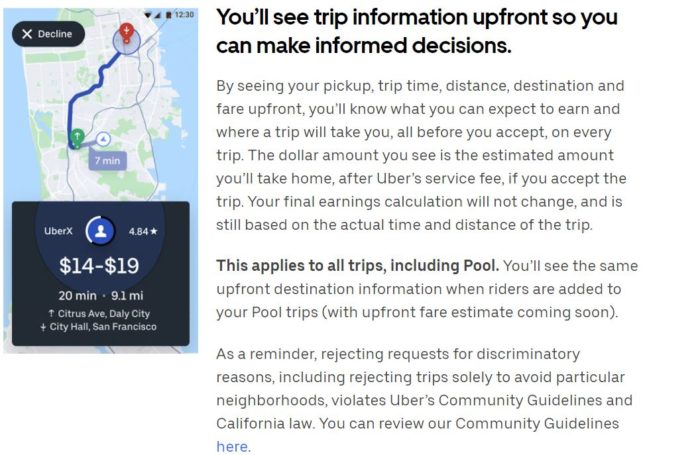

In response to evolving pressures from both drivers and regulators, Uber began rolling out changes to its platform in California starting Jan 1, 2020. The changes reflect Uber’s ongoing commitment to drivers’ independent contractor status, with inherent flexibility focus for the driver.

Simultaneously, Uber wants to strengthen its legal case in California identifying itself as a technology platform between driver and passenger. The updates are restricted to California at this time.

The key points to take away from the Uber update rollouts in California:

- Time & Distance rates are unaffected thus far

- Drivers can see the trip destination before accepting the ride

- Drivers can see the trip earnings in advance

- Uber continues to adjust Booking and Service Fees

- Passengers can now “favorite” a driver and request them in the future and in advance timing.

Delivery Driver Uber Guide to Money in 2020 Maximizing Earnings with the Uber App

With the updates for California Uber drivers Jan 1, 2020, making decisions on when and where to drive to maximize earnings is being viewed as an improvement by most drivers.

From the Uber update, see your trip earnings in advance.

Delivery Driver Strategies for More Uber Money in 2020

Uber will undoubtedly make future adjustments to its platform. The best delivery driver strategies for Uber Money in 2020 are to maximize the earnings from the Uber rideshare app and to also register with other apps to increase earnings further.

Uber’s’ reservation request for favorites promises further earning potential for drivers. Interested drivers may use the Favorites element of the app to create a clientele base to have a reliable income. By providing excellent 5-star service, Uber drivers can now create their own community of service.

Regardless of improvements to the Uber app, drivers need to focus on what returns the best income for the time invested. Conceptually, the name of the game is to transport as many paying passengers as possible in the least amount of time.

To do that Uber directs you through its app to the time and areas where the demands are the highest. The app encourages using surge pricing to indicate the areas requiring drivers. At any time, you may view your earnings and promotions on the app menu.

The promotions, Quest and Boost encourage drivers to reduce Uber fees charged to drivers by increasing passenger ride-time. Simply put, the more passenger rides provided, the higher take-home.

Using Uber Eats to Add Income

Uber encourages rideshare drivers to also register for Uber Eats. The signup process is less complicated than Uber rideshare and provides additional income opportunities.

Uber Benefits for Delivery Drivers

The Uber mission statement “We ignite opportunity by setting the world in motion” points to their technology platform creating motion for passengers and igniting dreams.

Uber makes a strong message that they are inclusive and actively advance the interests of the drivers who use their platform to earn income.

With a driver code, coupled with owning your business and increasing cash as needed, you have the added opportunity to advance personal goals through Uber with online educational assistance through Arizona State University.

In addition to the flexibility of driving with Uber, added benefits include;

- Local discounts on food and drinks

- Health Insurance through Stride

- Phone cost savings

- Financial and Accounting through Quickbooks

- Tax assistance through Turbotax

- Business Registration with Legalzoom

- Car Rental

Rideshare Debate

You are stepping into a job description that is rapidly evolving. Even the definition of what distinguishes a rideshare driver from a food delivery driver or an expedite freight driver lack clarity.

The result is a legal debate. Drivers on the one side cherish flexibility of work hours and want the protections of employment status for minimum wage and medical benefits.

Simultaneously, State governments claim drivers are employees until proven otherwise. An increasing number of states are attempting to use the “ABC” test to determine the independent status of the Uber driver.

The ABC Independent Contractor test describes the working conditions of the independent contractor.

Delivery Driver Uber Guide ABC Independent Contractor Test

- The worker cannot be under the control of the hiring entity for control of the performance of the work.

- The worker performs activity outside the normal course of work established by the hiring entity.

- The worker performs similar work for other hiring entities.

On the other side of the debate are the app technology platforms, like Uber and Lyft, that are still defining their roles and profit model. Rideshare platforms contend drivers are independent contractors.

The upcoming ballot proposals in California will undoubtedly create some clarity, however, this evolution is expected to languish for some time. At the present time, the Uber rideshare platform is regarded predominantly as an app technology conduit between the passenger and the driver. Drivers are not considered employees, therefore, have the flexibility to work desired hours. Drivers, therefore, do not participate in any worker protections for injury or benefit from healthcare options available to employees.

Going forward, Uber and Lyft will continue to influence the future of the entire gig economy. The evolution in the rideshare industry will impact independent contractor regulations well into the future.

My sage advice is to take advantage of the benefits of being an independent contractor and put your head down to focus on what makes the most money for you and your family.

Delivery Driver Uber Guide to Money in 2020 Delivery Driver Job Score

Many rideshare drivers start out driving, only to learn that the hours transporting passengers fall short of making enough profit to warrant the time invested. Expanding into other delivery options including meals, groceries, parcels, and dry-cleaning may fill the gap. The wide array of delivery driver jobs available offers various levels of satisfaction to drivers. Flexible hours of working may be the most important to one driver, while maximizing earnings per hour of driving may be the most important to another.

Rapidgo Driver examines each type of delivery driver opportunity mentioned and applies a score in the following areas of driver satisfaction. The purpose is to provide understanding and the ability to compare delivery driver opportunities. In this post, rideshare is examined for the following attributes.

- Cash Payout – Independent Delivery Drivers require fast payout to cover startup costs and daily expenses.

- Startup Costs – Delivery drivers starting out prefer low startup costs.

- The flexibility of Hours – Most drivers begin self-employment to add income using flexible work hours.

- Available Areas – Rideshare coverage and demand are essential to the driver’s earnings.

- Support – Wide-spread available support for drivers and passengers improves the experience for both.

- Growth – Opportunities for delivery drivers are expanding. Look for growing sectors.

Delivery Driver Uber Guide to Money in 2020 Rideshare Pros & Cons

My purpose in starting rideshare with Uber was to add extra incoming and to test the platform for other parcel and freight delivery drivers to expand their incomes. Yours may be greater flexibility of available times to earn income.

Each rideshare app is unique; however, the event is the same, pick up a passenger and deliver them safely to their destination. The same process is required for parcels, pantry meals and groceries, and, pickup requests. By comparing each area drivers become aware of available options to reach their personal goals of flexibility and income potential.

Delivery Driver Uber Guide to Money in 2020 Pros of the Uber Platform

- Cash Payout – Score: Rapid – 1-3 days with Cash Out option

- Expedited Payout available

The first advantage of attracting drivers to Uber is receiving payment as soon as possible after the successful completion of a ride.

Uber’s current pay period is from 4 AM Monday to 4 AM Monday. Drivers may expect to see direct deposit funds in their account by Wednesday to Thursday each week.

A Cash-Out option or Instant Pay is available that allows payment outside the weekly direct deposit. The Instant Pay transfers fund to an eligible debit card. Depending on the receiving bank, Instant Pay may take 1-3 days to appear on the debit card.

For a delivery driver starting up with Uber, fast payments provide money to replace fuel and cover living expenses.

- Startup Costs – Score: Low – $100’s

- License, Insurance, Vehicle

A low-cost startup is good. Startup costs for rideshare can be minimal beyond being a licensed, insured driver with access to a compatible car. Uber assists drivers to locate suitable cars in most areas.

Added startup costs to consider include phone car holder, front & back recording camera, snacks, sickness and comfort offerings for passengers.

- The Flexibility of Time– Score: Above Average

- Drive when available

The Flexibility of working hours remains important to drivers attracted to Uber. From students to retired seniors, a rideshare gig can provide extra income to subsidize budget needs. Typically, drivers determine a specific income goal in advance and continue to drive to earn a set dollar amount.

Numerous drivers I have interviewed reveal they are able to earn $400 per week in 20+ hours, including weekends and delivery for Uber Eats as well, while maintaining Platinum status. For students and winter vacation senior get-away, $400 per week is a comfortable part-time work schedule. For those drivers with more time and interest, Uber supports drivers to increase their income. Full-time drivers in the past have claimed to earn up to $60,000.

- Available Areas – Score: International

- App platform available in many countries

Although Uber is facing backlash in London, England, it is expanding in Canada and elsewhere. The rideshare model is being developed and tested around the world.

- Support – Score: Increasing

A sign and strength of the longevity of Uber is its driver and passenger support and attention. Although the model has imperfections, improving the quality of drivers with vetting and education promises to improve the safety of passengers.

Uber continues to adjust their app technology to compensate drivers for peak time and peak density service. Several methods include Quest, Boost, and “Favorites”.

- Growth – Score: Increasing

- Expansion, Commitment

As Uber defines its corporate role in the rideshare demand economy, drivers and government agencies will remain vocal in their contributions to Uber’s expansion.

At the base of the controversy is the label of “independent contractor” vs “employee with protections”. Several states are currently redefining the traditional “ABC” test for independent contractor status.

Uber maintains that drivers are independent, and the Uber rideshare model is based on passenger and driver use of an “App”. Therefore, as merely the provider of the app technology, they are devoid of responsibility toward benefits and hourly minimum wage regulations.

Many drivers fear being classed as employees, resulting in reduced ability to have flexible work times. Delineation of single app drivers versus drivers canvasing deliveries from multiple food apps as well as rideshare apps is still ill-defined and subject to future scrutiny.

Regulators see not only tax revenue but also reigning in a moving target as the Uber disruptive business model evolves. Both regulators and companies are in the learning process.

Sign up for Rapidgo Driver Weekly Newsletter Outtakes to stay up-to-date on the status of rideshare legislation and regulations.

Delivery Driver Uber Guide to Money Top Tips & Tricks for Drivers

If you are starting out as a driver, you cannot ride with another Uber driver to gain experience and learn the tips that will help you earn faster.

To stay current with the latest tips and tricks for Uber drivers, sign up for the top weekly outtakes on topics to help Uber and other delivery drivers make more money and stay safe.

Send us a comment or ask a question anytime. We will respond. Think of us as your ride-along expert to answer your questions as they come up.

Delivery Driver Uber Guide to Money Basic Rules for Drivers and Passengers

Uber has basic rules for drivers and passengers. You cannot eat, drink, smoke or have a weapon in the car.

Uber has a FAQ section that will help explain many basic dos & don’ts. Simply condensed, passengers and drivers are required to treat each other respectfully.

Safety for Passenger and Driver

Uber has expanded the PIN security feature for passengers. See the video HERE. Both driver and passenger may end the ride at any time.

From the Uber site:

Since its inception, Uber has provided riders with the car make and model, license plate, driver name, and photo. Uber says riders should always confirm this information before getting into the car. This extra layer of verification is to help provide riders and drivers with more peace of mind before a trip can begin in the app.

Rapidgo Driver encourages all delivery drivers to protect themselves with personal alarms and to have a plan for protecting themselves and their passengers. Sign up for weekly outtakes for the latest driver protective measures.

Delivery Driver Uber Guide to Money in 2020 on Tipping

The rideshare Uber model is based on the service a driver provides. As with food service, for example, the better the service, the higher the tips for appreciation. Simply said, be really nice. Here are several suggestions to increase service to passengers

- At the end of this ride, if you could give me an honest rating, I would appreciate it – this acts as a reminder to the passenger to open the rating screen on the rider Uber app where the tipping is suggested. This also encourages the Uber driver to give 5-Star service.

- If you have a favorite route to your destination today, please let me know – the number one complaint riders have is that drivers don’t know the best route to take.

- Thank you for the opportunity to be of service today. Please let me know if you would like a charger or water refreshment. – Even if declined, the offer helps increase tips.

- If you experience car-sickness, please help yourself to the car-bag in the back of the seat. – It will be appreciated by the passenger and keep your car cleaner.

Rapdigo Driver may earn a commission from links.

Delivery Driver Uber Guide to Money in 2020 Conclusion & Outtakes

The Uber technology platform continues to be the largest rideshare innovator in North America. Rapidgo Driver and community are dedicated to helping delivery drivers using the Uber app to reach their goals in 2020.

The Delivery Driver Uber Guide to Money in 2020 gives you the advantage of having an in-depth understanding of many of the aspects needed to rapidly develop a self-employed side-gig with Uber. Simultaneously, you are developing your own delivery driver business. Reaching your goals will require getting clear on the results you want, focusing on the steps needed, and concentrating on maximizing income and reducing expenses.

- Step 1 Define Your Outcome

- Step 2 Obtain Your Uber Driver Code

- Step 3 Maximize Your Earnings and Minimize Your Expenses

My recommendation is for you to get started with Uber rideshare now and increase your level of expertise as both a driver and business owner as you progress. Use Driver or Rider Invite Code: JAMESF98VUE and sign up for Weekly Newsletter Updates to earn fast. There will be ample time, while you are waiting for the next run, to educate yourself further and implement the suggestions mapped out here. Even if you are not covering all your expenses from day one, you are creating additional cashflow and learning a new skill. I wish you success in reaching your goals.

If you think that I left something out of the ultimate Delivery Driver Uber Guide, leave a comment and let me know how Rapdigo Driver can help you.